5 things to know before the stock market opens Wednesday

Here are the most important news items that investors need to start their trading day:

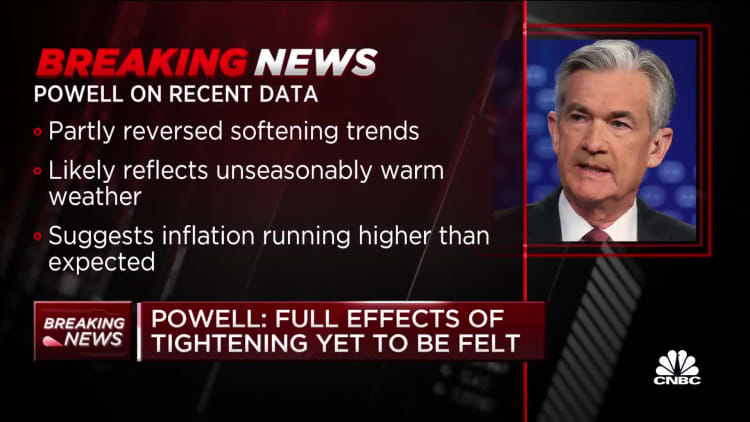

1. Powell brings the pain

Stocks sold off broadly and bond yields spiked Tuesday as Federal Reserve Chairman Jerome Powell told senators that rates will likely end up higher than anticipated. The Dow dropped by about 575 points, while the S&P 500 and the Nasdaq declined 1.53% and 1.25%, respectively. Powell also warned that, if economic data continue to run hot, the Fed could return to quicker rate hikes after easing off the pedal during recent policy-setting meetings. There’s more to come, too. Powell is scheduled to speak again Wednesday, this time in front of the House Financial Services Committee. Follow live markets updates.

2. Biden targets TikTok

A Senate bill that would give the Biden administration the power to ban Chinese-owned social video app TikTok just got a big, if not surprising, boost. The White House on Tuesday endorsed the bipartisan legislation and urged lawmakers to pass it quickly. The bill, dubbed the RESTRICT Act, would allow the Commerce secretary to review certain deals, software updates and data transfers, and then refer them to the president if there is an “undue or unacceptable risk” to national security. Then, the president can take action. “This bill presents a systematic framework for addressing technology-based threats to the security and safety of Americans,” Jake Sullivan, national security advisor to President Joe Biden, said in a statement.

3. More headaches for Fox

Fox Corp

, the parent company of right-wing cable channels Fox News and Fox Business, ran into a double whammy Tuesday. First, host Tucker Carlson came under bipartisan criticism for airing a package of security video from the Jan. 6, 2021, U.S. Capitol riot that suggested it was a peaceful event, and not what it actually was: a bloody attempted coup that has resulted in the indictments of hundreds of people. Then came the latest document dump from Dominion Voting’s $1.6 billion defamation suit against Fox. Revelations included Fox Chairman Rupert Murdoch suggesting that hosts Sean Hannity and Laura Ingraham “went too far” in embracing Donald Trump’s false election fraud claims, as well as host Maria Bartiromo saying that she wouldn’t let her team refer to Joe Biden as “president-elect.” The Dominion-Fox trial is set to begin in mid-April.

4. Buffett makes a bigger bet on oil

Warren Buffett can’t get enough of Occidental Petroleum

. Berkshire Hathaway

, the billionaire’s Nebraska-based conglomerate, snapped up about 5.8 million shares in the oil giant over the course of Friday, Monday and Tuesday, according to regulatory filings. The purchases brought Berkshire’s stake in Occidental to 200.2 million shares, or about $12.2 billion as of Tuesday’s close. Occidental was a big-time performer in 2022, an otherwise down year for the markets, its stock more than doubling in value. It’s now among Berkshire’s top 10 holdings, CNBC’s Yun Li reports.

5. Big twist in the Nord Stream story

Blockbuster reports from The New York Times and The Washington Post say U.S. intelligence officials believe a pro-Ukraine group may be behind an attack last year on the undersea Nord Stream natural gas pipelines that connect Russia and Europe. Officials believe the saboteurs could be a combination of Ukrainian and Russian nationals, the Times said. Officials do not believe Ukrainian President Volodymyr Zelenskyy or his top aides were involved, or that Ukrainian government officials ordered the action, according to the Times. Russia, whose unjustified invasion of Ukraine has gone on for more than a year, met the reports with a mix of outrage and frustration. “We are still not allowed in the investigation. Only a few days ago we received notes about this from the Danes and Swedes,” a Kremlin spokesman said.